Crypto tax calculator usa

Taxpayers are required to pay taxes on their crypto in the US. Short-term crypto gains on purchases held for less than a year are subject to the same tax rates you pay on all other income.

14 Best Crypto Tax Software To Ease Your Calculation And Be Compliant Geekflare

If you are using ACB Adjusted cost base method the cost basis of sale will be determined by.

. The information provided on this website is general in nature and is not tax accounting or legal advice. The popularity of cryptocurrencyBitcoin investments continues to skyrocket. 10 to 37 in 2022 depending on your federal.

Yes CryptoTaxCalculator is designed to generate accountant friendly tax reports. 14 Jul 2022 10min read Recommended reads. 15 Best Crypto Tax Softwares Calculators in 2022.

You have investments to make. Tax doesnt have to be taxing. How to calculate tax on ETH gas.

Let us handle the formalities. Check out our free Cryptocurrency Tax Interactive Calculator that in just one screen will answer your burning questions about your cryptocurrencyBitcoin sales and give. Enter the sale date and sale price.

Enter the purchase date and purchase price. In this example the cost basis of the 2 BTC disposed would be 35000 10000 500002. This cryptocurrency tax guide covers everything you need to know about cryptocurrency tax laws in the USA.

The purchase date can be any time up to December 31st of the tax year selected. The capital gain in this transaction can be calculated with the cost basis of 3000 Purchase price of 03 units of Bitcoin and the capital proceeds of 4500 Exchange value of 03 units of. Let us do that for you.

Crypto tax calculators are essential for every trader and throughout this article we will cover the best crypto tax. Stop worrying about record keeping filing keeping up to date with the evolving crypto tax code. US Tax Guide 2022.

Free Crypto Tax Calculator for 2021 2022. Over the last decade cryptoassets have burst on to the investment scene and captured the imagination of investors all over the world. There are some strategies that you can use to minimize the results of using a crypto tax calculator including.

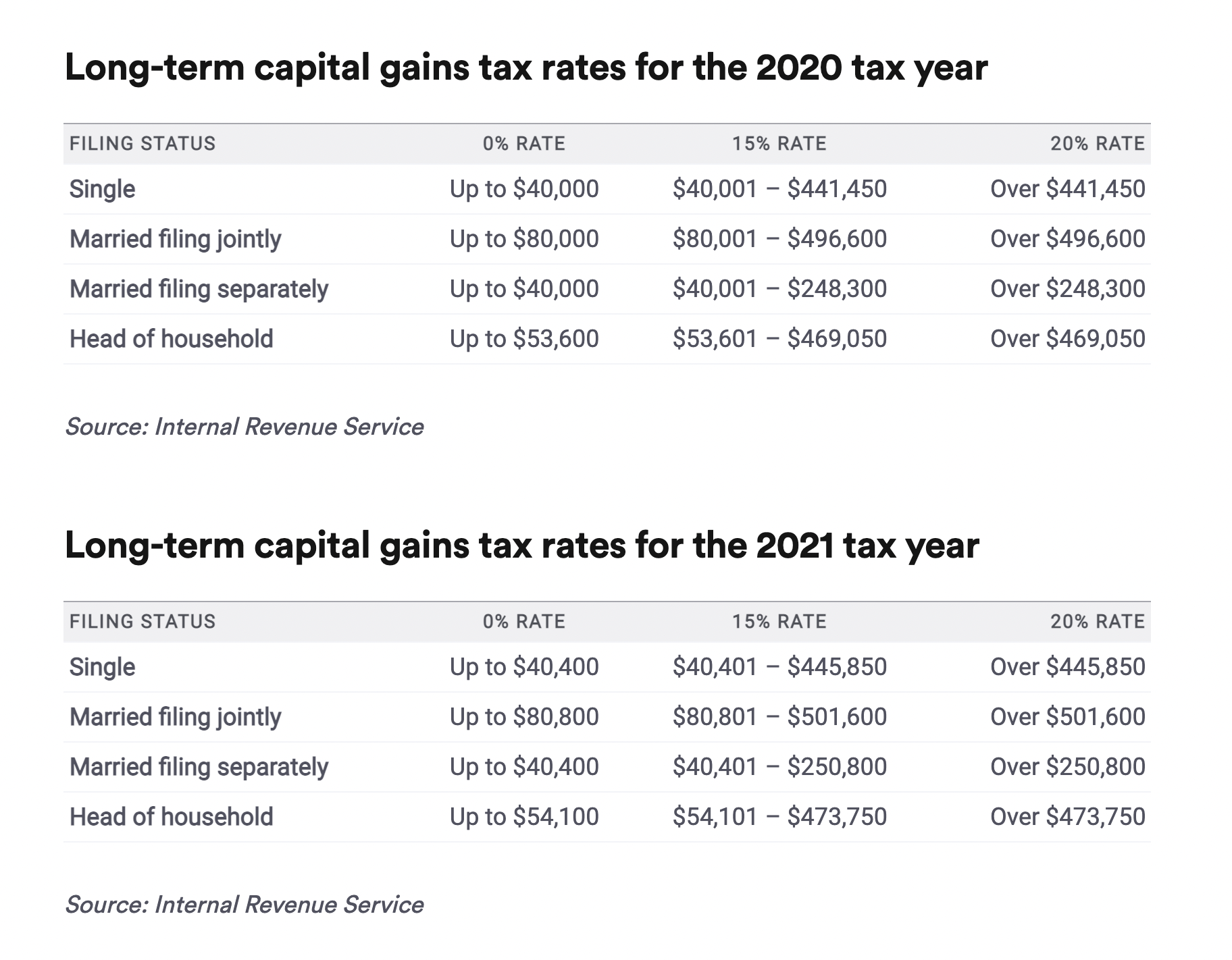

Forbes recently posted this handy guide with a chart of the 2020-2021 tax brackets for your reference. Your cryptocurrency tax rate on federal taxes will be the same as your capital gains tax rate. Stay up to date with the latest crypto tax regulations.

According to a May 2021 poll 51. As a refresher short-term capital gains had a rate of 10 to 37 in 2021 while. How to Minimize Your Crypto Taxes.

After importing and reconciling all your transactions ensure your Tax Portfolio settings are all set and the report has been refreshed. If your annual income is less than 9875 youll be subject to a 10 tax rate on your. Straightforward UI which you get your crypto taxes done in seconds at no.

This means you can get your books. As with any investment it is. You simply import all your transaction history and export your report.

Contact Us Looking to get in touch. On the Reports page choose.

Calculate Your Crypto Taxes With Ease Koinly

Cryptocurrency Tax Guides Help Koinly

14 Best Crypto Tax Software To Ease Your Calculation And Be Compliant Geekflare

How To Use Crypto Com Tax Software Free Crypto Tax 2021 2022 Calculator Cheatsheet Fangwallet

Cryptocurrency Tax Calculator Forbes Advisor

Made A Killing With Crypto In 2021 How To Calculate Your Tax Bill

Coinpanda Free Bitcoin Crypto Tax Software

![]()

Cointracking Crypto Tax Calculator

![]()

What Is My Tax Rate For My Crypto Gains Cointracker

Crypto Tax Calculator Accointing Com

10 Best Crypto Tax Software In 2022 Top Selective Only

Crypto Tax Calculator

Capital Gains Tax Calculator Ey Us

Made A Killing With Crypto In 2021 How To Calculate Your Tax Bill

![]()

Cointracking Crypto Tax Calculator

Crypto Tax Rates Capital Gains Tax A Break Down On How It All Works

Crypto Tax Calculator